Get a mobile app that is compliant with all SCA & dynamic linking requirements, offering an enhanced level of security and seamless user experience.

SCA & dynamic linking

Mitigate fraud risks in a compliant way

The PSD2 mandates SCA procedures to be applied when accessing accounts online and for initiating payments. The scope of SCA and dynamic linking is to improve the security of payment experience, minimise fraud risk, and guarantee customer protection.

The RTS on SCA implies that the end-customer's identity must be verified using at least two of the following authentication methods: knowledge, possession and inherence. Each element must be independent, so that the breach of one element will not compromise the others. Dynamic linking represents a security element for payments and is realised through the generation of an authentication code that is linked to payment amount and payee of transaction.

Request a demoHow it works

When compliance meets customers' convenience

Growth in online and mobile payments has been followed by an online fraud boom. Every customer expects convenience but doesn’t want to lose security during the payments or mobile banking operations, that is why Mobile SCA becomes a genuine solution to meet all the needs.

About Mobile SCA

Deliver a frictionless authentication experience

Salt Edge has developed the Mobile SCA application to handle dynamic linking and meet the strong customer authentication requirements. The solution simplifies the access to banks’ and EMIs’ digital channels, granting a user-friendly and secure authentication and authorisation process.

Salt Edge Mobile SCA combines the world's best UX and security practices to offer you a solution that makes your business and customers' payment experience much better and safer.

Open Banking Compliance

Become fully open banking compliant in just 1 month

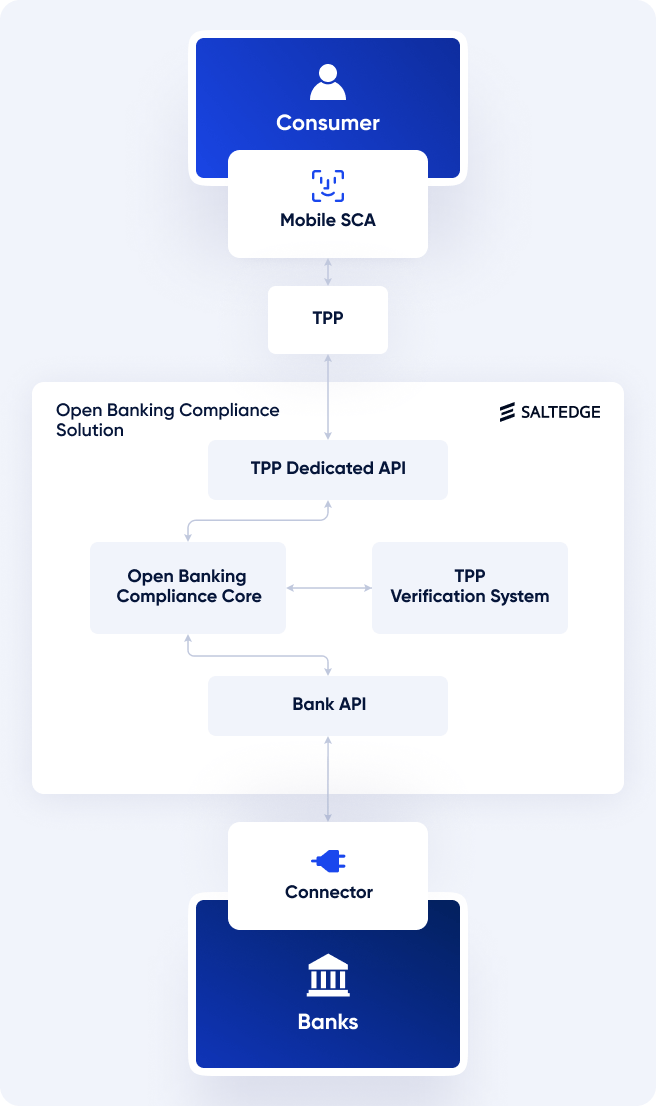

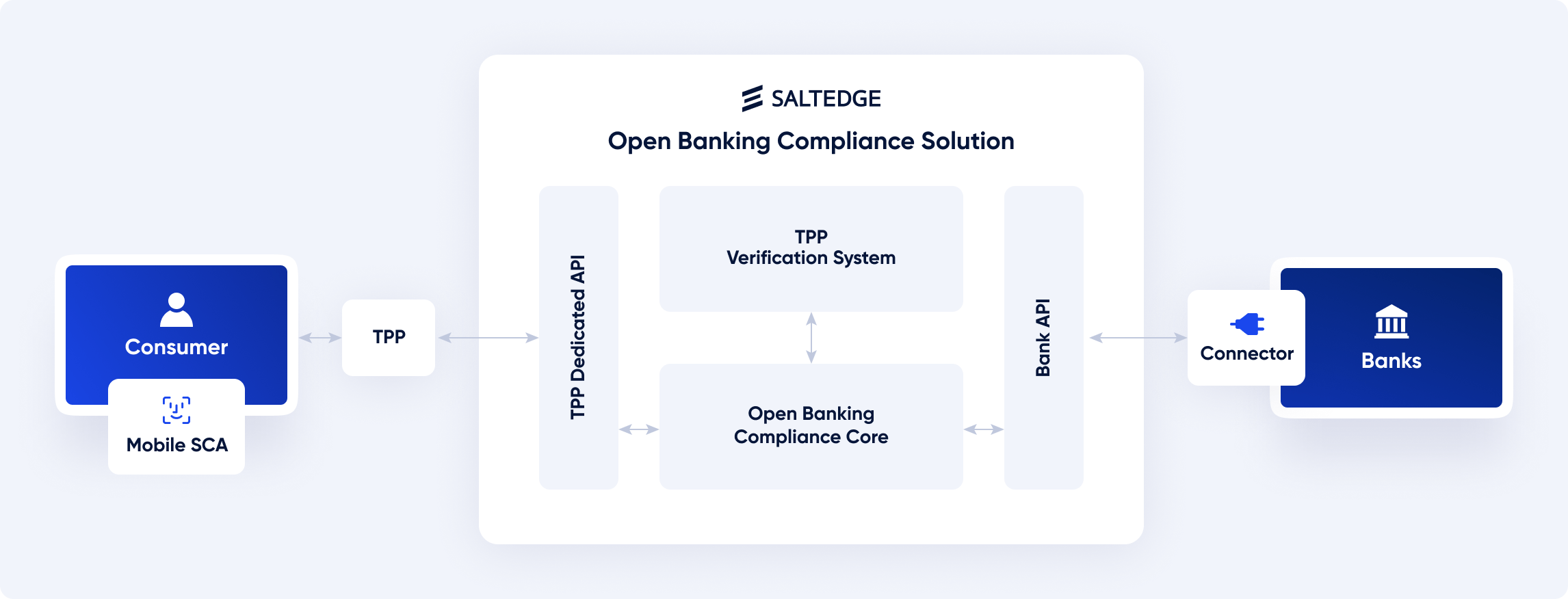

Mobile SCA is built to secure digital access and is also available as a component of the comprehensive Salt Edge Open Banking Compliance Solution. Being a cost-effective and reliable SaaS solution, Salt Edge Open Banking Compliance offers a targeted approach that strikes the right balance between security and user convenience, requiring minimum technical participation from the ASPSP’s side.

SCA experience for

- Mobile SCA answers both security and SCA compliance challenges for banks. They trust Salt Edge's mobile solution to deliver secure and seamless digital banking services to their customers.

- Byblos Bank Europe, a bank that provides commercial banking services for retail and institutional customers, uses Salt Edge Mobile SCA to grant their end-customers the possibility to authorise transactions, creating a streamlined user experience. Mobile SCA meets all the strict regulatory requirements and enables a single-point access for end-users to all their accounts at Byblos Bank Europe.

- Mobile SCA is successfully used by EMIs to comply with SCA requirements while maintaining a seamless user experience. With value-added features, such as password-free authentication, electronic signature, consent management, Salt Edge Mobile SCA brings an even better user experience which improves customers' loyalty and trust.

- Digital assets marketplace Globitex leverages Salt Edge's Mobile SCA to ensure that its EURO Wallet customers benefit from a secure environment for payments and account access, in line with the PSD2 requirements.

- Get a unique opportunity to offer your clients including banks and EMIs countless benefits from providing a PSD2 and SCA compliant, secure and seamless payments experience. Now your clients have the opportunity to bring open banking one step closer to their end-customers, in just one month.

- Pannovate leverages white-labeled Salt Edge Mobile SCA to grant banks' and EMIs' end-customers the possibility to authorise transactions, creating a safe and seamless user experience.

- Intrasoft International, a global ICT company, joined hands with Salt Edge to help banks and EMIs with PSD2 & SCA compliance. Intrasoft supports digital transformation and industry-specific initiatives and uses Salt Edge Mobile SCA to create a secure payment environment.

Benefits

Perfect match between safety and convenience

They trust Salt Edge